Subpilot Introduces Bill Negotiation Feature to Help Users Reduce Monthly Expenses Automatically

Subpilot now auto-negotiates your bills & cancels subscriptions for you—no calls, no hassle. Making your monthly expenses more manageable.

CAMDEN, DE, UNITED STATES, February 17, 2026 /EINPresswire.com/ -- The personal finance app expands beyond subscription management to tackle recurring bills through automated analysis and provider negotiation.Subpilot, a personal finance app designed to help users regain control over recurring expenses, today announced the expansion of its platform with a dedicated Bill Negotiation feature, aimed at helping consumers lower monthly bills through automated analysis and plan optimization.

Subpilot was built to address a growing problem in modern personal finance: the accumulation of subscriptions and recurring charges that often go unnoticed, unmanaged, or overpaid. By connecting securely to a user’s email and bank account, the app automatically detects subscriptions and recurring bills, giving users a centralized view of where their money is going—and where savings opportunities exist.

At the core of Subpilot’s platform is its subscription detection system, which identifies recurring charges using multiple data sources, including billing and receipt emails, connected bank transactions, and manual user inputs. This multi-layered approach allows Subpilot to uncover hidden subscriptions, forgotten free trials, and recurring charges that users may not actively track.

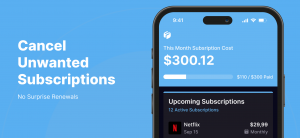

Once identified, Subpilot’s Cancel Subscription feature lets users cancel unwanted services directly in the app. By handling complex cancellation flows on the user’s behalf—often involving logins, customer support interactions, or confusing account portals—the feature reduces friction and helps users save both time and money.

The newly emphasized Bill Negotiation feature expands Subpilot’s value beyond subscriptions. Available as part of the app’s premium offering, the feature analyzes recurring bills such as internet, phone, streaming services, utilities, and other ongoing expenses. Using transaction-level data and uploaded billing information, Subpilot identifies potential overpayments, outdated plans, or inefficiencies that may be driving unnecessary costs.

The process begins with a detailed expense analysis that combines bank transaction data with billing statements to provide users with a clear picture of recurring spending. From there, Subpilot identifies opportunities for savings and works to secure discounts, negotiate with providers, or recommend optimized plans better aligned with the user’s actual usage. The result is measurable, ongoing monthly savings without requiring users to spend hours comparing plans or contacting providers themselves.

“Recurring bills are often treated as fixed costs, even when they’re not,” said a spokesperson for Subpilot. “Our goal is to help users challenge that assumption by making bill optimization automatic, data-driven, and accessible.”

With its expanded focus on bill negotiation, Subpilot positions itself as more than just a subscription tracker. By combining subscription detection, cancellation automation, and recurring bill optimization into a single platform, the app offers users a practical and easy way to reduce financial waste and build healthier monthly spending habits.

About Subpilot

Subpilot is a personal finance app that helps users discover, manage, and cancel subscriptions while reducing recurring expenses through automated analysis of financial data and bills. By connecting to users’ email and bank accounts, Subpilot identifies subscriptions and recurring charges, helps cancel unwanted services, and enables ongoing monthly savings through bill negotiation and plan optimization.

Anthony Mayilamene

Subpilot

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.