Crowdfunding Market Size to Reach USD 5.91 Billion by 2034 | CAGR 13.70% (2026-2034)

The global crowdfunding market size is projected to grow from $2.11 billion in 2026 to $5.91 billion by 2034, at a CAGR of 13.70% during the forecast period

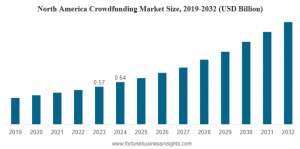

North America dominated the global market with a share of 39.60% in 2025.”

NEW YORK , NY, UNITED STATES, February 7, 2026 /EINPresswire.com/ -- According to Fortune Business Insights, the global crowdfunding market size was valued at USD 1.83 billion in 2025 and is projected to grow from USD 2.11 billion in 2026 to USD 5.91 billion by 2034, exhibiting a CAGR of 13.70% during the forecast period. North America dominated the global market with a share of 39.60% in 2025. Crowdfunding has evolved into a mainstream financing model that enables startups, small businesses, creators, and social initiatives to raise capital directly from a large pool of contributors through digital platforms, reducing reliance on traditional financial institutions.— fortune business insights

Size, Share, and Industry Analysis

The crowdfunding market continues to expand as digital payment infrastructure, mobile penetration, and online trust mechanisms improve worldwide. The industry is witnessing strong participation from entrepreneurs and investors seeking alternative funding options with lower entry barriers. Equity-based and reward-based crowdfunding models are gaining traction, while donation-based crowdfunding remains vital for social and humanitarian causes. The increasing number of campaigns across technology, healthcare, creative industries, and sustainability sectors highlights the market’s growing economic relevance.

Get a Free Sample of this Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/crowdfunding-market-107129

Key Market Insights

One of the most significant insights shaping the crowdfunding market is the shift from experimental fundraising to structured investment ecosystems. Platforms are introducing enhanced due diligence, campaign verification, and investor protection features to improve credibility. Another notable insight is the increasing participation of institutional investors alongside retail backers, which is helping large-scale campaigns achieve funding goals faster while improving overall market confidence.

Global Market Overview

Globally, crowdfunding adoption is accelerating due to the democratization of finance and widespread internet access. Emerging economies are increasingly leveraging crowdfunding to support innovation and entrepreneurship where traditional financing remains limited. The rise of cross-border crowdfunding platforms is also enabling campaigns to attract international backers, expanding funding potential beyond domestic markets and driving global market integration.

Market Trends

A major trend in the crowdfunding market is the growing use of blockchain and tokenization to enhance transparency and traceability in fundraising. Equity crowdfunding platforms are increasingly adopting secondary trading options, allowing investors to exit positions more easily. Additionally, niche crowdfunding platforms focused on specific sectors such as healthcare research, clean energy, and creative media are gaining popularity as backers seek more targeted investment opportunities.

Market Growth Factors

The primary growth driver for the crowdfunding market is the increasing demand for alternative financing among startups and small businesses. Rising awareness of crowdfunding benefits, such as faster fundraising cycles and direct customer engagement, is also fueling adoption. Supportive government regulations in several countries, coupled with tax incentives for early-stage investments, are further accelerating market growth. The expansion of digital wallets and secure online payment systems has also reduced transaction friction for contributors.

Segmentation Analysis

By type, the market is segmented into donation-based, reward-based, equity-based, and debt-based crowdfunding. Equity-based crowdfunding is experiencing the fastest growth due to its potential for higher returns and increased investor interest. By end user, startups and small enterprises dominate the market, followed by creative professionals and non-profit organizations. Industry-wise, technology and healthcare sectors account for a significant share due to high innovation activity and funding requirements.

Regional Analysis

North America leads the crowdfunding market due to its mature digital ecosystem, strong startup culture, and favorable regulatory frameworks. Europe follows closely, supported by increasing cross-border crowdfunding initiatives and harmonized regulations. Asia Pacific is emerging as a high-growth region, driven by rising entrepreneurial activity, expanding internet access, and growing awareness of crowdfunding platforms. Latin America and the Middle East & Africa are also showing steady growth, supported by financial inclusion initiatives.

Key Industry Players

The competitive landscape of the crowdfunding market is shaped by platforms focusing on innovation, transparency, and user experience. Leading players include Kickstarter, which dominates reward-based crowdfunding for creative projects, Indiegogo, known for flexible funding options and global reach, GoFundMe, which leads in social and personal fundraising campaigns, and SeedInvest, a rapidly growing platform focused on startup equity investments.

Get a Free Sample of this Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/crowdfunding-market-107129

Key Industry Developments

Recent developments in the crowdfunding market include the integration of artificial intelligence for campaign optimization and fraud detection. Platforms are increasingly using data analytics to help creators design more effective campaigns and target relevant audiences. Strategic partnerships between crowdfunding platforms and financial institutions are also expanding access to larger funding pools while improving regulatory compliance and investor protection standards.

Opportunities and Future Outlook

The future of the crowdfunding market looks promising as new technologies and regulatory clarity continue to enhance platform credibility. Opportunities are emerging in impact crowdfunding, where investors support environmentally and socially responsible projects. As investor education improves and digital trust increases, crowdfunding is expected to become a standard component of the global financing ecosystem, particularly for early-stage innovation.

AI Overview: Crowdfunding Market

The crowdfunding market is growing rapidly due to rising demand for alternative financing and digital fundraising platforms. Equity and reward-based crowdfunding models are gaining strong momentum globally. North America leads the market, while Asia Pacific shows high growth potential. Technological advancements and supportive regulations are shaping long-term market expansion.

Frequently Asked Questions

What is the current size of the crowdfunding market?

The global crowdfunding market was valued at USD 1.83 billion in 2025 and is expected to reach USD 5.91 billion by 2034, growing at a CAGR of 13.70%.

Which crowdfunding model is growing the fastest?

Equity-based crowdfunding is witnessing the fastest growth due to increasing investor participation and higher return potential.

Why is North America dominating the crowdfunding market?

North America leads due to strong startup ecosystems, advanced digital infrastructure, and favorable regulatory support for crowdfunding platforms.

What factors are driving crowdfunding market growth?

Key drivers include rising startup funding needs, increasing digital adoption, supportive government policies, and growing investor awareness.

Read Related Reports:

Crowdsourced Security Solutions Market

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.