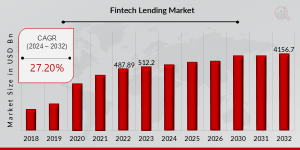

Fintech Lending Market to Reach USD 4,156.7 Billion by 2032 | Expected CAGR 27.20% (2024–2032)

Fintech Lending Market Research Report By, Loan Type, Repayment Method, Interest Model, Delivery Channel, Regional

TX, UNITED STATES, August 18, 2025 /EINPresswire.com/ -- The global Fintech Lending Market has witnessed exponential growth in recent years and is expected to expand dramatically over the coming decade. In 2022, the market size was estimated at USD 487.89 billion and is projected to grow from USD 512.2 billion in 2023 to an impressive USD 4,156.7 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 27.20% during the forecast period (2024–2032). The growth is primarily driven by the rising adoption of digital lending platforms, increasing demand for alternative credit solutions, and technological innovations in financial services.Key Drivers Of Market Growth

Rising Adoption of Digital Lending Platforms- Consumers and businesses are increasingly leveraging online and mobile platforms for faster, more convenient access to credit. Fintech lending platforms provide streamlined application processes, quick approvals, and flexible repayment options.

Growing Demand for Alternative Credit Solutions- Traditional banking channels often have stringent requirements, leading borrowers to seek alternative lending sources. Fintech lenders offer tailored credit products, peer-to-peer lending, and SME financing solutions.

Technological Innovations in Financial Services- Artificial intelligence, machine learning, and blockchain technology are transforming risk assessment, credit scoring, and transaction security. These innovations enhance operational efficiency, reduce defaults, and improve customer experience.

Expanding Financial Inclusion- Fintech lending is bridging gaps in underserved markets by providing credit access to individuals and small businesses in regions with limited banking infrastructure.

Get a FREE Sample Report – https://www.marketresearchfuture.com/sample_request/22833

Key Companies in the Fintech Lending Market Include

• LendingClub Corporation

• SoFi Technologies, Inc.

• Rocket Companies, Inc.

• Upstart Holdings, Inc.

• Kabbage (American Express)

• OnDeck Capital, Inc.

• Wise (formerly TransferWise)

• Prosper Marketplace, Inc.

• Ant Group

• Jumpstart, Inc.

• Fair Finance Group

• Credit Karma

• PayPal Holdings, Inc.

• Avant, LLC

• Revolut Ltd., among others

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/fintech-lending-market-22833

Market Segmentation

To provide a comprehensive analysis, the Fintech Lending market is segmented based on type, application, and region.

1. By Type

• Consumer Lending: Personal loans, student loans, and digital credit products for individuals.

• Business Lending: SME financing, invoice financing, and working capital loans.

• Peer-to-Peer (P2P) Lending: Direct lending between individuals or businesses via online platforms.

2. By Application

• Personal Loans: Short-term and long-term consumer credit products.

• SME Financing: Working capital and growth funding for small and medium enterprises.

• Mortgage & Real Estate Loans: Digital lending solutions for property acquisition and refinancing.

3. By Region

• North America: Dominates due to advanced fintech infrastructure, high digital adoption, and regulatory support.

• Europe: Growth driven by expanding digital banking, government initiatives, and alternative lending solutions.

• Asia-Pacific: Fastest-growing region, fueled by digital payment adoption, fintech startups, and financial inclusion programs.

• Rest of the World (RoW): Increasing fintech adoption in Latin America, the Middle East, and Africa, driven by emerging economies and mobile banking growth.

Purchase Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22833

The global Fintech Lending market is on a trajectory of extraordinary growth, driven by technological innovations, digital adoption, and increasing demand for alternative credit solutions. As fintech platforms continue to expand their reach and financial services evolve, the market is set to redefine traditional lending paradigms through 2032.

Top Trending Research Report :

Equity Indexed Life Insurance Market - https://www.marketresearchfuture.com/reports/equity-indexed-life-insurance-market-24126

Family Floater Health Insurance Market - https://www.marketresearchfuture.com/reports/family-floater-health-insurance-market-24130

Fire Insurance Market - https://www.marketresearchfuture.com/reports/fire-insurance-market-24107

Gap Insurance Market - https://www.marketresearchfuture.com/reports/gap-insurance-market-23997

Group Life Insurance Market - https://www.marketresearchfuture.com/reports/group-life-insurance-market-24012

Healthcare Insurance Market - https://www.marketresearchfuture.com/reports/healthcare-insurance-market-24032

Home Insurance Market - https://www.marketresearchfuture.com/reports/home-insurance-market-24090

Income Protection Insurance Market - https://www.marketresearchfuture.com/reports/income-protection-insurance-market-24041

Telecommunications Insurance Market - https://www.marketresearchfuture.com/reports/telecommunications-insurance-market-24091

Trade Credit Insurance Market - https://www.marketresearchfuture.com/reports/trade-credit-insurance-market-24106

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.